Asking the Tough Questions

Roles, Authority, Responsibility, and Accountability in Construction Fleet Management

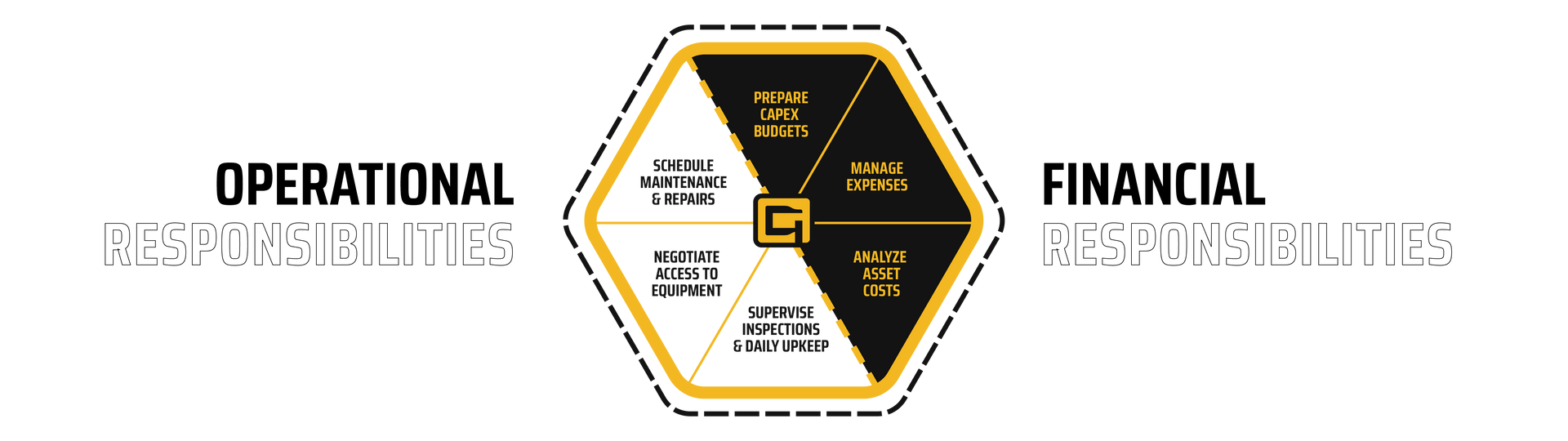

In the construction industry, managing a fleet is about much more than keeping machinery running—it’s about ensuring your equipment contributes strategically to both operational success and your company’s financial health. Often, fleet management teams operate with unclear or undefined roles, which can lead to inefficiencies, lost opportunities, and increased costs. The key to turning this around lies in asking some difficult but essential questions about how equipment is managed, tracked, and integrated across various departments.

This article aims to spotlight critical questions that will help you assess the roles, authority, responsibility, and accountability within your fleet management operations. By answering these questions, you can strengthen your fleet management strategy, improve communication with other departments, and make more informed decisions that align with both operational and financial goals. This will be the foundation of the organizations focus to improve and optimize the fleet.

How Does Your Organization View Equipment? As a Tool or as an Asset?

The first question you need to ask yourself is: How does your organization view its equipment? Is it merely a tool to get the job done, or is it considered a valuable asset on the balance sheet?

- Is your equipment tracked as an asset on the balance sheet?

Many construction companies tend to see their equipment as a tool—something that’s just there to perform a function. However, if equipment is seen only as a tool and not as an asset, it may not be managed properly, and its full value is not realized. Equipment should be considered a long-term asset, subject to depreciation and lifecycle management, much like any other major capital investment. If your fleet team isn't regularly interacting with accounting and finance departments, the true cost of owning and maintaining equipment may not be factored into financial decision-making.

- Are you considering Total Cost of Ownership (TCO)?

Beyond the purchase price, the Total Cost of Ownership (TCO) includes ongoing costs such as fuel, repairs, insurance, and maintenance, as well as any downtime costs and the resale value of the asset at the end of its life cycle. Is your fleet team fully integrated with finance and accounting to ensure these costs are being tracked and managed accurately? If not, you could underestimate your fleet’s impact on your overall financial health.

Does Your Equipment Group Regularly Interact with Accounting, IT, and Finance?

Communication between departments is essential to avoid operational silos. Does your Equipment Group regularly interact with the accounting, IT, and finance teams? Collaboration across these departments is crucial for ensuring that equipment management aligns with overall company strategy.

- Are you aligning equipment management with financial planning?

The equipment you own, or lease is often one of your company’s largest assets. By integrating equipment management with financial forecasting, accounting can better understand the long-term implications of equipment purchases and maintenance schedules. Is the Equipment Group included in CAPEX planning, and do you have access to financial insights that inform your asset lifecycle management?

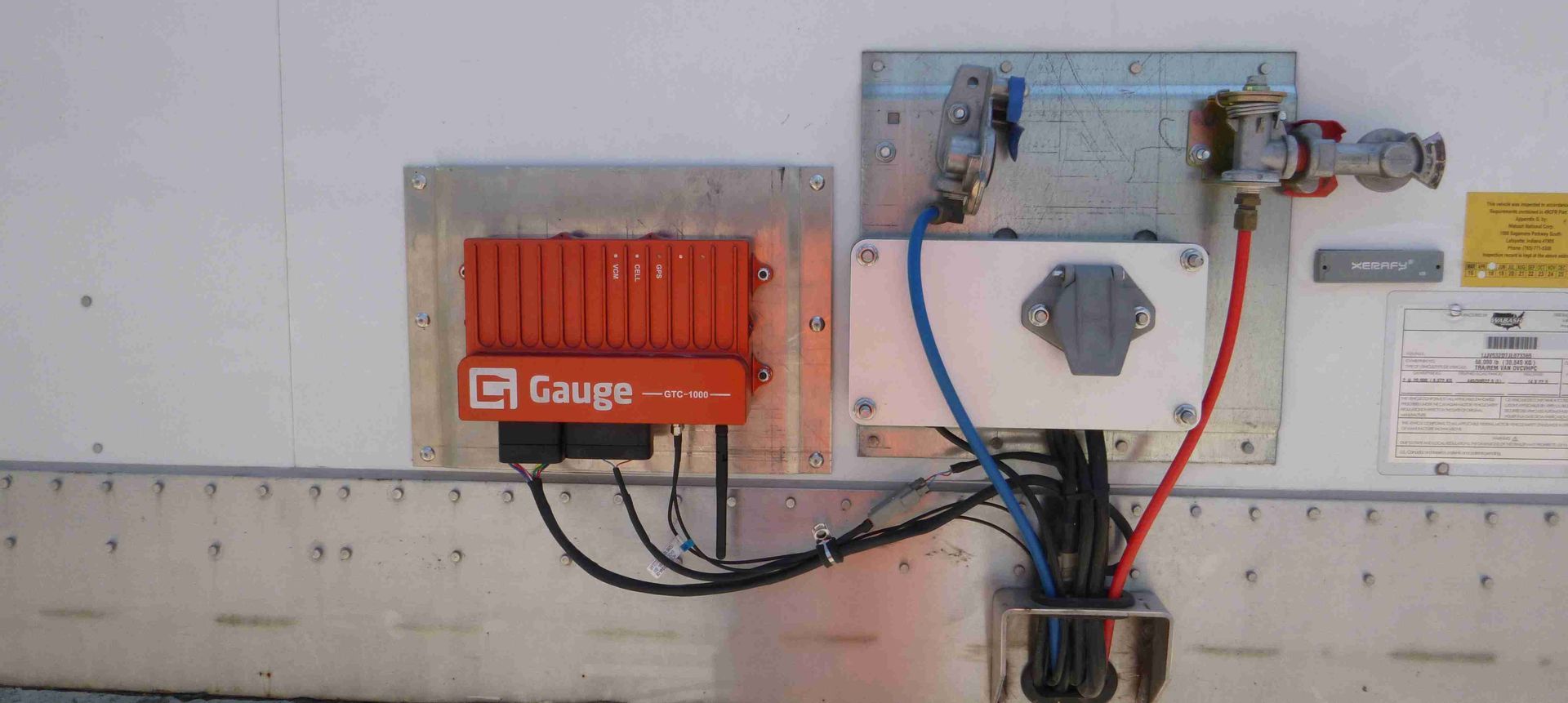

- Is your equipment data flowing seamlessly between systems?

If your IT department isn’t fully supporting the Equipment Group with integrated systems, or if your fleet management software isn't integrated with your enterprise resource planning (ERP) system, there’s a risk of data gaps. Having disparate systems creates inefficiencies and introduces the potential for errors in asset tracking, costing, and reporting. Is your CMMS (Computerized Maintenance Management System) integrated with your ERP? A fully integrated system provides visibility across departments, ensuring that the data needed for financial reporting, asset management, and forecasting is synchronized.

Are You Involved in the CAPEX Budget Planning Process?

One critical area where fleet management must have a seat at the table is in CAPEX (Capital Expenditures) budget planning. Without your input, the organization may overlook key considerations when purchasing or replacing equipment.

- How do you align CAPEX investments with fleet strategy?

Incorporating fleet management into the CAPEX planning process ensures that purchasing decisions are based on both operational needs and financial realities. Does your fleet management team understand the long-term impacts of equipment investments on company cash flow, asset utilization, and project timelines? Involving fleet management in the planning process allows for better forecasting and strategic decision-making.

- Are you planning for future equipment needs?

Long-term planning for replacing or upgrading equipment is essential to avoid costly emergency purchases and unplanned downtime. If the Equipment Group is not involved early in the budgeting process, there is a risk that outdated or underperforming equipment may be relied on longer than necessary, increasing costs and reducing productivity.

Do you have an organizational structure to support the Equipment Group?

- Do you have clear job descriptions and responsibilities?

Having clearly defined roles within the Equipment Group is essential for managing assets properly. Does each team member understand their specific responsibilities, from tracking asset usage to ensuring timely maintenance? A lack of clarity in roles can lead to missed maintenance schedules, inefficiencies in asset utilization, and inconsistent reporting.

- Is there a succession plan for your equipment managers?

What happens if your fleet manager leaves the organization? Without proper succession planning, key knowledge about asset history, usage, and condition could be lost. Are you actively preparing for the next generation of fleet leaders to ensure continuity and effectiveness in managing your fleet?

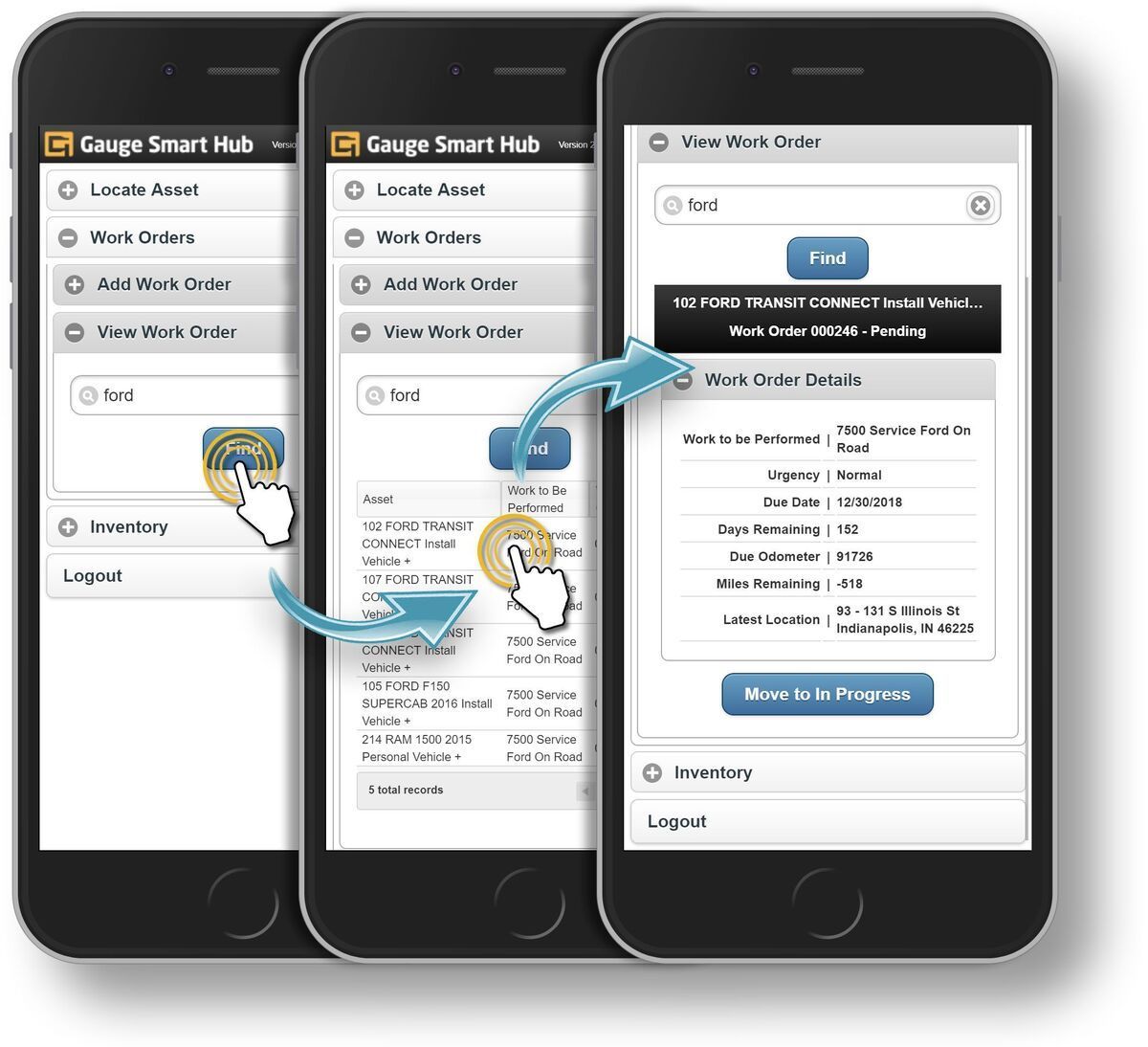

Leveraging a CMMS to Share Insights with the Financial Team

A Computerized Maintenance Management System (CMMS) is essential for streamlining your fleet management operations. It allows you to track the health and performance of each asset, but it also serves as a key tool for communicating data with other departments, especially accounting and finance.

- Data-Driven Decision Making

A CMMS gives you the power to move beyond gut-feelings and make decisions based on data. Are you using your CMMS to track asset depreciation, maintenance history, repair costs, and uptime? Does this data flow into your ERP system, giving your financial team insights into the true cost of each asset? By integrating this data into your financial planning process, you enable more informed, strategic decisions that improve the company's bottom line.

- Building Transparency and Accountability

A CMMS also enables transparency. Every piece of equipment has a documented history, from routine maintenance to unexpected repairs. This helps build a culture of accountability across teams and provides ownership over asset management. When you have access to accurate, real-time data, you can better share insights and progress with company owners and financial leaders, helping them make better decisions for the business.

Do You Have a Fleet P&L (Profit and Loss) Statement?

Having a Fleet P&L (Profit and Loss) statement can be a game-changer for managing equipment as a business unit. This financial tool helps you track revenue generated by equipment use, costs associated with operating the fleet, and the overall profitability of the fleet.

- Are you managing your assets like a business?

With a Fleet P&L, you can isolate costs related to specific equipment, including repairs, maintenance, fuel, insurance, and depreciation, and compare them to revenue generated. Do you have the ability to see which equipment is underperforming and which is generating solid returns? Having a Fleet P&L helps you manage the financial performance of the fleet just like any other revenue-generating unit, which is crucial for cost optimization and profitability.

Final Thoughts

To manage a construction fleet effectively, it's critical to address roles, authority, responsibility, and accountability at every level. By asking tough but essential questions—such as how your organization views its equipment, whether the Equipment Group interacts regularly with finance, and whether you have access to integrated systems like a CMMS and ERP—you can begin to break down silos and better align operations with strategic business objectives.

Moreover, having clarity around the CAPEX budget planning process, job descriptions, and succession planning will ensure that your equipment is not only managed effectively but is also an asset that contributes to the long-term success of the company. Ideally as you progress through this journey you are able to develop strategic goals that guide the teams decisions. An example of these would be for the organization to understand their costs, conserve capital, and prevent failures.

By leveraging tools like a Fleet P&L and integrating real-time data from your CMMS, you can bring more transparency and accountability into fleet management, enabling more informed decisions and helping your organization stay competitive, profitable, and future-ready.

SOLUTIONS

markets

PRODUCTS

resources

Get in touch

Phone: 317-472-6455

info@gaugecorp.com

stay-up-to-date

Sign up for the Gauge Newsletter

Thank you for contacting us.

We will get back to you as soon as possible.

Please try again later.